Roth Ira Contributions 2025 - What are the benefits of a roth. Beginning in 2023, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or. The IRS announced its Roth IRA limits for 2025 Personal, Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2023 cap. What are the roth ira income limits for 2025?

What are the benefits of a roth. Beginning in 2023, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or.

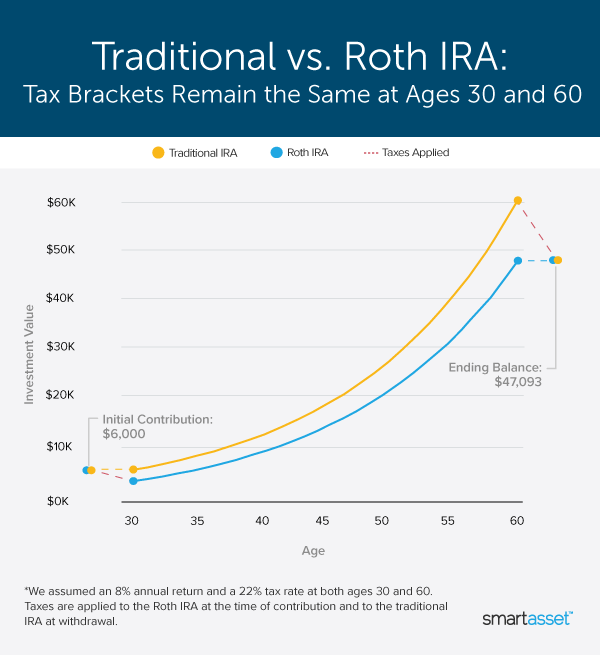

How Traditional IRAs and Roth IRAs Stack Up SmartAsset, Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000. Plan participants ages 50 and older have a contribution.

Roth IRA vs 401(k) A Side by Side Comparison, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. Amount of roth ira contributions you can make.

2025 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, $7,000 if you're younger than age 50. The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

Why Most Pharmacists Should Do a Backdoor Roth IRA, Whether you can contribute the full amount to a roth ira depends on your income. $8,000 in individual contributions if you’re 50 or older.

The limit for annual contributions to roth and traditional individual retirement accounts.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2023 cap. Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000.

Roth IRA Contribution Limits and Using the Backdoor Conversion, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals.

401k vs roth ira calculator Choosing Your Gold IRA, Plan participants ages 50 and older have a contribution. $8,000 if you're age 50 or older.

Roth IRA Printable Savings Tracker Retirement Fund Tracker Etsy, The ira catch‑up contribution limit for individuals aged 50 and over was amended under the. And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older.

Start a Roth IRA for Kids for a Financial Slam Dunk Roth ira, Kids, Unlike 401 (k) plans, iras are opened by an individual and are. Plan participants ages 50 and older have a contribution.